Table of Content

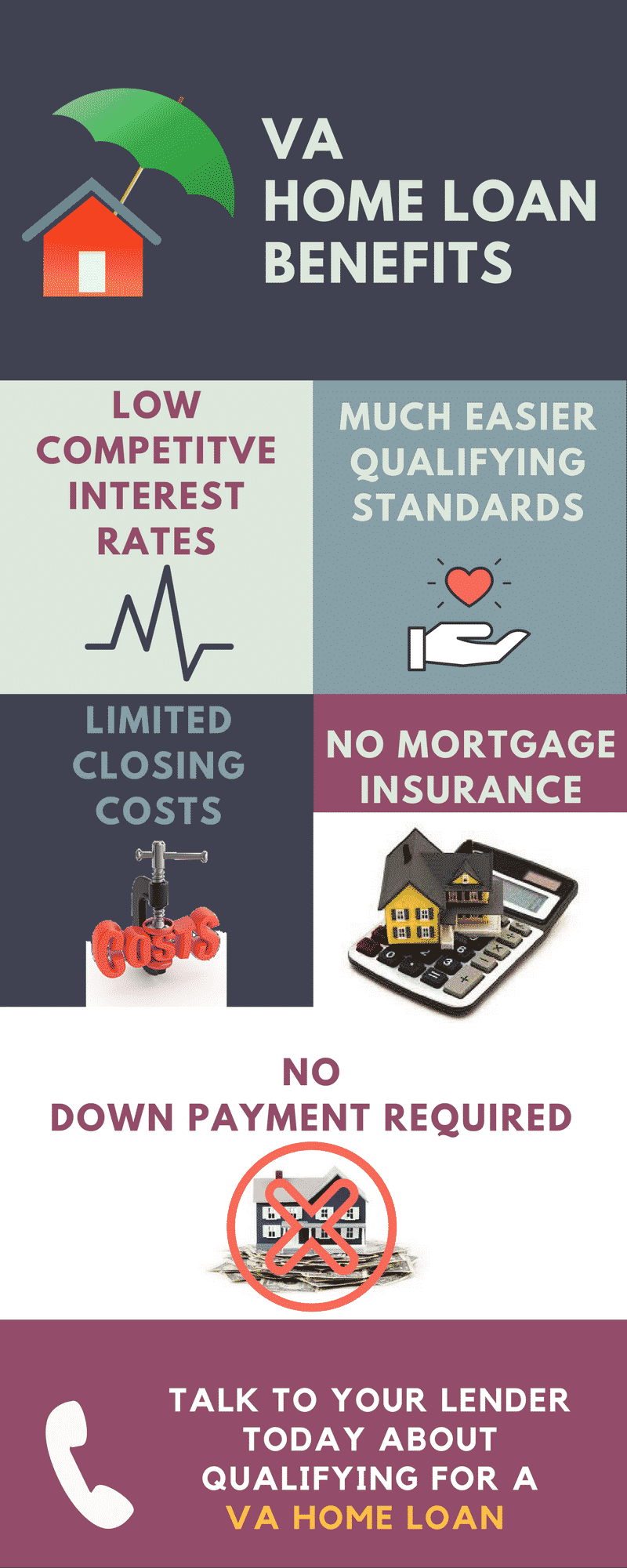

With the average listing price of a home in Louisiana landing at $323,502, the VA loan’s signature $0-money-down benefit is a considerable advantage for Louisiana homebuyers. Not affiliated with the Dept. of Veterans Affairs or any government agency. Help us help vets with an individual contribution in your community. The best way to impact the vets around you is with hands-on assistance through your business, a veteran service organization, and in your community. You can also help our emergency aid initiative with a donation to the Military Family Assistance Fund. Enlisted veterans whose service began after September 7, 1980, or officers whose service began after October 16, 1981, must normally have served at least two years.

If someone in your family is helping you with that down payment, it is called a Gift of Equity, a special VA loan program. Yes, Borrowers who qualify for a VA mortgage will almost always be required to pay a funding fee. According to the VA.gov, the VA funding fee in 2021 is 2.3% of the home's principal amount. If you've utilized the VA mortgage program previously, you'll have to pay a slightly higher 3.6%. This increase can also be mitigated by contributing 5% or more as a down payment. As of January 1, 2020, VA borrowers in Louisiana with their full VA loan entitlement are not restricted by VA loan limits.

Check VA Loan Eligibility

If you are interested in buying your new house of your dreams, don’t hesitate to contact us by filling out the form below. Our Loan Officers are highly trained and experts in this field. We will help you through the entire process hassle free. We have been helping veterans get the home of their dreams for many years, you can read ourtestimonials here, hundreds of Veterans now are home owners, join them today. This is another LHC program offering assistance for prospective homebuyers who need help with down payment and closing expenses. VALoanCenter.net is not a government agency website or affiliated with the Department of Veterans Affairs.

You will now be able to tab or arrow up or down through the submenu options to access/activate the submenu links. When determining how much you'll pay each month for your VA home loan, these are the key factors you need to consider. See our full VA home loan calculator for more details.

Home Loan Pre-Qualification Inquiry

VALoans.com is not affiliated with or endorsed by the Department of Veterans Affairs or any government agency. Visitors with questions regarding our licensing may visit the Nationwide Mortgage Licensing System & Directory for more information. Channing was very helpful answering any questions that I had, as a first time home buyer, about the whole process and any questions that came up with the figures.

If you are already discharged, you must also have an honorable or anything other than dishonorable discharge to use your VA home loan benefit. To access the menus on this page please perform the following steps. To enter and activate the submenu links, hit the down arrow.

VA Loan Calculator

While it might not be required in every state, termite and pest inspections are a vital part of the VA home loan process. Not everyone who served is automatically eligible for a VA loan. In order to qualify for a VA loan, you'll need to meet a few requirements.

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. Requirements for VA mortgages are generally set along the same lines as conventional home loans. In addition to functioning electrical and plumbing systems, your target property will need to have a safe source of water.

Famed explorer Hernando de Soto later navigated the state, coming into contact with the Caddo and Tunica tribes. The first permanent settlement in the state was established by France in the late 17th century. Following their defeat during the Seven Years War, France transferred control of the area to Spain. Eventually, the territory was re-ceded to France under Napoleon Bonaparte, before being sold to the United States in 1803 as the Louisiana Purchase. The territory would be split to form 15 separate states, as well as two Canadian provinces.

This means you can borrow as much as a lender is willing to lend without needing a down payment. VA loans are made by private lenders and guaranteed by the Department of Veterans Affairs. Because private lenders make the loans and not the VA, you need to find a lender licensed in the state you plan to purchase or refinance. We’ll help you clearly see differences between loan programs, allowing you to choose the right one for you whether you’re a first-time home buyer or a repeat buyer. Veterans can achieve their dream of owning a home with the VA home loan benefit.

This helps reduce the amount of cash you need out of pocket at the closing. If you defaulted on a VA home loan, you lose that portion of your entitlement. Typically, you need two years of ‘clean credit’ to qualify. This means two years from the date of the bankruptcy discharge or the foreclosure sale.

You can refinance your outstanding loan amount, plus any amount of equity you want to take from the home. You can borrow up to 100% of the home’s value with the VA cash-out refinance. Your monthly payment only consists of principal, interest, real estate taxes, and homeowners insurance. If you buy a $200,000 home, the seller can help with up to $8,000 in closing costs. The down payment is where you get the most benefits out of your VA loan. Stable income and employment – You must prove stable income either via the military or your civilian job.

If a veteran is already in a VA loan they can take advantage of a reduced documentation refinance by using the streamline program to lower their payments. VA streamline refinance – If you have a current VA loan and just want to lower the interest rate or change the term, the VA streamline program is an option. You don’t have to verify your qualifying requirements for this program. The VA requires on-time mortgage payments and a benefit for refinancing – that’s it. Some lenders may have additional requirements, which we will walk you through.

No comments:

Post a Comment