Table of Content

This helps reduce the amount of cash you need out of pocket at the closing. If you defaulted on a VA home loan, you lose that portion of your entitlement. Typically, you need two years of ‘clean credit’ to qualify. This means two years from the date of the bankruptcy discharge or the foreclosure sale.

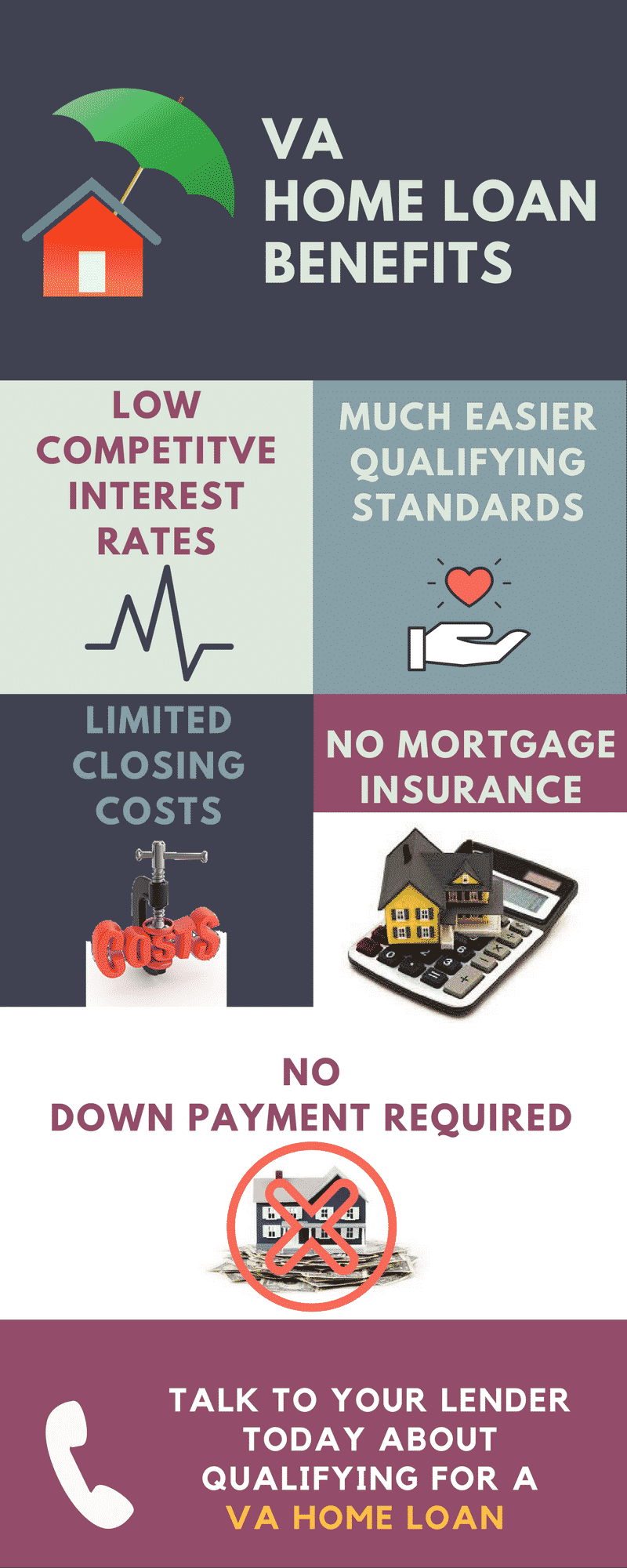

Depending on the applicant's service history and current status, the conditions for providing proof of service can vary. Our mission is to provide anyone with VA eligibility the best mortgage possible in the state of Louisiana. Saving enough money for a down payment can be especially difficult for active duty service members who are moving from base to base. Since there is no down payment required for a VA Home Loan, many veterans can purchase a home with little to no money out of pocket.

Loan Approval Requirements

The VA promises to pay the lender back 25% of the loan amount if an eligible veteran defaults on the loan. If you’re experiencing financial hardship due to the COVID-19 emergency, you can request a temporary delay in mortgage payments. Savings, if any, vary based on consumer’s credit profile, interest rate availability, and other factors. Guaranteed Rate, Inc. is a private corporation organized under the laws of the State of Delaware. It has no affiliation with the US Department of Housing and Urban Development, the US Department of Veterans Affairs, the US Department of Agriculture or any other government agency. Before approving a VA mortgage, the Department of Veterans Affairs will usually need to ensure that risk is minimized.

If you choose to get prequalified, you'll provide documentation that outlines your financial situation, such as bank statements, pay stubs and credit reports. This information is then reviewed by your lender, who is able to determine if you're an acceptable candidate for a loan, and if so, what kind of mortgage rate will be offered. Proof of service requirements can include discharge or separation papers, history of retirement benefits, or signed statements of service. May be used by veterans and unmarried surviving spouses of those who died of a service-connected disease or disability, to purchase or refinance a home. These loans are issued by participating lenders; lender standards may apply. Veterans are not specifically targeted with this program but those who meet income and purchase requirements are welcome to apply.

Louisiana VA Home Loan Limits

If you are already discharged, you must also have an honorable or anything other than dishonorable discharge to use your VA home loan benefit. To access the menus on this page please perform the following steps. To enter and activate the submenu links, hit the down arrow.

Please refer to chapter 8 of The Lender's Handbook - click here. If so, the loan must be underwritten on the basis of the projected active duty income. Credit scores are not required, however, most lenders have their own minimum credit score requirements. The Leave and Earnings Statement must identify service members who are within 12 months of release from active duty or end of contract term.

Loan Types Requiring Prior Approval

Wood-destroying insect information is required for all properties. The Department of Veterans Affairs guarantees mortgages originated by VA Home Loan Centers. The state was first explored by Europeans in 1528 when the Spanish expedition of Panfilo de Narvaez discovered the mouth of the Mississippi River.

The entitlement is the amount the VA will guarantee your loan. The VA guarantees 25% of the loan amount up to the national conforming amount of $484,350. VA does not recognize certain closing costs as charges/fees that the Veteran is allowed to pay. VA does not set a percentage of allowable closing costs, they refer to what is typical for the area.

Get Your VA Home Loan in Illinois Today!

Most of the time the buyer’s agent doesn’t cost the buyer anything. However if you purchase a home not listed with a realtor they may not be willing to compensate your realtor. VA cash-out refinance – Any veteran with eligibility can use the VA cash-out refinance.

Contrary to popular belief, you don’t get a VA loan right from the VA. The company name, Guaranteed Rate, should not suggest to a consumer that Guaranteed Rate provides an interest rate guaranteed prior to an interest lock. No, however, depending on your state and county, you could receive a tax exemption. Your spouse was missing in action or a prisoner of war for at least 90 days. Your spouse was killed in service or from a service-related disability.

Neither VALoans.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with the Dept. of Veterans Affairs or any other government agency. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you.

He did a great job shopping around for the best rate for me. Will definitely recommend Bayou Mortgage to anyone looking to buy a home. If you meet these criteria, you should have access to your Certificate of Eligibility. The COE shows lenders the amount of your entitlement for a VA loan.

While it might not be required in every state, termite and pest inspections are a vital part of the VA home loan process. Not everyone who served is automatically eligible for a VA loan. In order to qualify for a VA loan, you'll need to meet a few requirements.

No comments:

Post a Comment