Table of Content

WhatWasThere overlaps historical photos to present images on Google Maps. The website allows you to tour through a street and witness what it once looked like in the past. You’re able to both learn new information, as well as confirm details you’ve already collected. “Many states maintain their own official lists of inventories or registers of historic and cultural resources,” says Jeff Joeckel, an archivist with the National Register of Historic Places.

The claims information in this report will include information on the date of the property loss, as well as amounts paid. Previous claims against a property can impact your insurance premiums and may need to be factored into your bid price. The Resource forum is where you may discover that the type of house you’re considering buying is perfect for your needs … or is going to be way more effort to maintain than you want to expend.

View houses in Dallas that sold recently

By getting the previous selling price of a home you want, you will find out if the house has appreciated in value and by how much. You can use several resources to get the past selling price of the home, some of which may charge a small fee. In the United States, Existing Home Sales occur when the mortgages are closed. Mortgage closing usually takes place days after the sales contract is closed.

In the new construction segment, a shortage of materials can also slow down the building of homes. The pandemic disrupted the lumber industry in spring and summer of 2020, as sawmills ceased operations and led to a backlog. Meanwhile, there has been a growing demand for timber among DIY renovators who suddenly found themselves at home with the time to tackle projects.

Real Estate Agent

Build on the purchase-only data by adding transactions from FHA and county recorder data . You might have to do a bit of digging and get creative in how you approach the search, but once you locate a lead, the effort will be well worth it. You can search through the Arcadia Publishing database by ZIP code, subject, or title to find a book that might have the property listed.

With the release of the 2012Q2 data a small but notable revision was made to how the HPI is calculated. The revision impacts the all transactions index at the state and national level for the full history of the series . Fannie Mae and Freddie Mac purchase seasoned loans, providing new information about prior quarters. The San Francisco Federal reserve borrowed an approach from finance literature. The finance paradigm holds that an asset has a fundamental value that equals the sum of its future payoffs, each discounted back to the present by investors using rates that reflect their preferences. For stocks, the payoffs requiring discounting are the expected dividends.

How Do I Search Public Records for Home Ownership?

Expand this block to see the historical median price of single family homes in the United States. 2) Fannie Mae and Freddie Mac purchase seasoned loans, providing new information about prior quarters. The Case-Shiller Indexes are value-weighted, meaning that price trends for more expensive homes have greater influence on estimated price changes than other homes. FHFA’s valuation data are derived from conforming mortgages provided by Fannie Mae and Freddie Mac. The Case-Shiller Indexes use information obtained from county assessor and recorder offices. The Case-Shiller Indexes® only use purchase prices in index calibration, while the all-transactions HPI also includes refinance appraisals.

The median existing-home price for all housing types was $379,100, up 6.6% from October 2021. Properties typically remained on the market for 21 days in October, up from 19 days in September. The data relating to real estate for sale on this web site comes in part from the IDX Program of the Greater El Paso Association of REALTORS®.

As a new homeowner, it’s important to enjoy all the benefits of owning your own home, but it’s also important to protect your investment. This is as simple as making your monthly mortgage payments on time and keeping up with regular updates and maintenance of your home. You’ll need to bring your ID, a copy of your Closing Disclosure, and proof of funds for your closing costs.

Your DTI ratio is a relatively simple representation of how much debt you can comfortably support with your income and how much money you have to spend on a mortgage each month. The other misconception, and probably the more unfortunate, is the belief that you need a 20% down payment. The fact of the matter is that few people actually put 20% down on a new home. Although the qualifying DTI will vary by mortgage loan products and underwriting qualification, generally we want to see a DTI below 50% at a minimum.

This site is not authorized by the New York State Department of Financial Services. No mortgage applications for properties located in the state of New York will be accepted through this site. Although such an option might exist from time-to-time, most homeowners need to have some cash for a down payment. For $12, the site will compile a report that tells you whether a death has occurred in your home and when it happened. Beyond that, it will also tell you if there have been any fire incidents or meth activity in the house. But the website DiedInHouse.com will tell you whether anyone has died in your home.

We’re going to carefully walk you through step-by-step on how to purchase the right home at the right price, with a mortgage you can live with. Of all the major U.S. metros, Sacramento was the most searched for destination among homebuyers looking to relocate between Sep '22 - Nov '22. San Francisco was the most searched for destination among homebuyers looking to leave, followed by Los Angeles, New York, Washington and Chicago.

There are a variety of factors and services that determine what you will pay in closing costs - title insurance and fees, appraisal, credit report, etc. Once you have determined the amount of monthly mortgage payment you can afford, it’s essential to begin saving for a down payment and closing costs. This can vary widely, depending on economic conditions, mortgage loan market conditions, and your lender’s current risk tolerance. If your credit score is at least 620, more options are available. And, if you can get your credit score over 720 you’re not only going to have the most options, but also the best loan terms. On this page is a home price affordability history tool for the United States.

He has more than 20 years of experience working with the National Park Service. Some online parcel details will also include a sketch vector of the house. From the sketch vector, you can learn what parts of the house are original and what parts are additions. It may also show you if the house has a wood deck with a roof, or a raised enclosed porch. A title should tell you the age of the house and whether it has ever been remodeled. If appropriate permits weren’t filed for certain remodel projects, the information may not be accurate, though.

Using the Historical Home Price Tool

The good news is that most conventional loan programs only require a 3% down payment and FHA loans have a minimum down payment of 3.5%. The general rule of thumb is that the larger your down payment the more loan options you will have and typically lowers your monthly payments and lowers your interest rate. Your credit score, and the credit score of any co-borrower, will be a critical factor in determining the loan programs and interest rates you qualify for. One other consideration in determining the amount of savings you need to have to buy your home is the closing costs - a variety of fees required to create your loan.

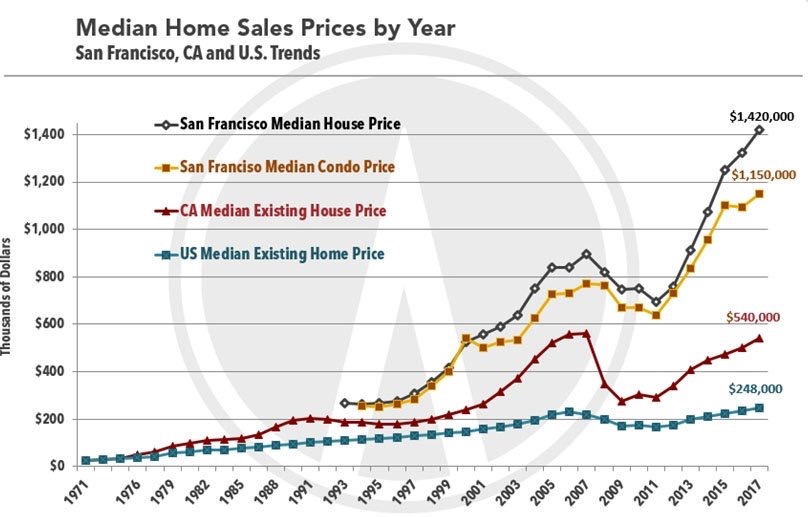

In the below chart, you’ll see short-term price fluctuations from one month to the next, which can feel substantial to homeowners at the time. Also notice the sharp dip from 2007 to 2009 triggered by the subprime mortgage crisis and subsequent housing market crash. In each release, FHFA publishes rankings and quarterly, annual, and five-year rates of changes for the MSAs and Metropolitan Divisions that have at least 15,000 transactions over the prior 10 years. In this release, 245 MSAs and Metropolitan Divisions satisfy this criterion. For the remaining areas, MSAs and Divisions, one-year and five-year rates of change are provided. Information, rates and programs are subject to change without notice.

No comments:

Post a Comment